Why the Youth Jobs Crisis Should Matter to Everyone (Alex Felsky, @AlexFelsky)

Do you know what it’s like to struggle to get a job in your field, after having been to college or university and incurring tens of thousands of dollars in debt from student loans? You can’t find work in your field because most openings say they require experience, yet you can’t get experience because no one will hire you. It’s a vicious cycle.

Though you’ll hear some people say, “Yes, but in Brant we have much lower unemployment than the provincial average,” these numbers don’t include people who had to move away for work, those who have given up or those who are employed precariously through contract work, temp agencies or unskilled labour, often working several part-time low paying jobs.

Students finishing high school and pondering their options for post secondary have a lot to weigh. On one hand, a degree is becoming a prerequisite for many jobs. On the other, no longer does it guarantee a comfortable middle class existence, especially if you have to go into debt to achieve it. It’s not unusual to find young couples starting out who have $100, 000 in student debt. Being saddled with large debts and low paying jobs mean that these young people are having to put off starting families and home ownership several years later than previous generations.

People like Shelly wrote, “I am 29 years old and I made the decision to higher my education and go for my career job, only to discover I put myself $17,000 in debt with no job to go to out of College. I thought I was making the right decision so that I could make more being a College graduate and land myself a great career. I have been applying just about every day to many positions and receive no responses. I am now working at Tim Hortons again, which I could have done without paying $17,000.00 to go back to College, to try and pay off my student loan.” Her story is not uncommon.

I know about this on a personal level as well. When I graduated university in 2003, all the work available to me was not permanent, but contract based. This meant no benefits, no pension and no guarantee of a renewed contract because of funding shortfalls. So, I cobbled together a few jobs at a time. And these were not jobs one usually thinks of as precarious or underpaid. These jobs including counselling work, teaching assistant work, community services work for adults with disabilities, work as an employment coordinator, and coordinator of large research projects in academia. I decided that I would be better off to pursue self-employment and have been fortunate to find success with my business. Through all this, I was one of the lucky ones; I graduated debt free because I had full tuition scholarships and worked throughout my education, and had parents with good jobs which meant they could help by cashing in the RESP’s they had saved for me. I can’t imagine I would have had the opportunity to launch a small business if I had been repaying student debt.

Today, new graduates face an ever more precarious and uncertain future. The cruel irony is that though an undergraduate degree does protect you from poverty, students have been telling me their stories about choosing to go back for a Master’s degree in the hopes that another degree will set them apart from the pack and enable to them to pay back their undergraduate loans, but many are finding out that it’s a risky gamble because to do so, they are taking on ever more debt and the job openings are still few and far between.

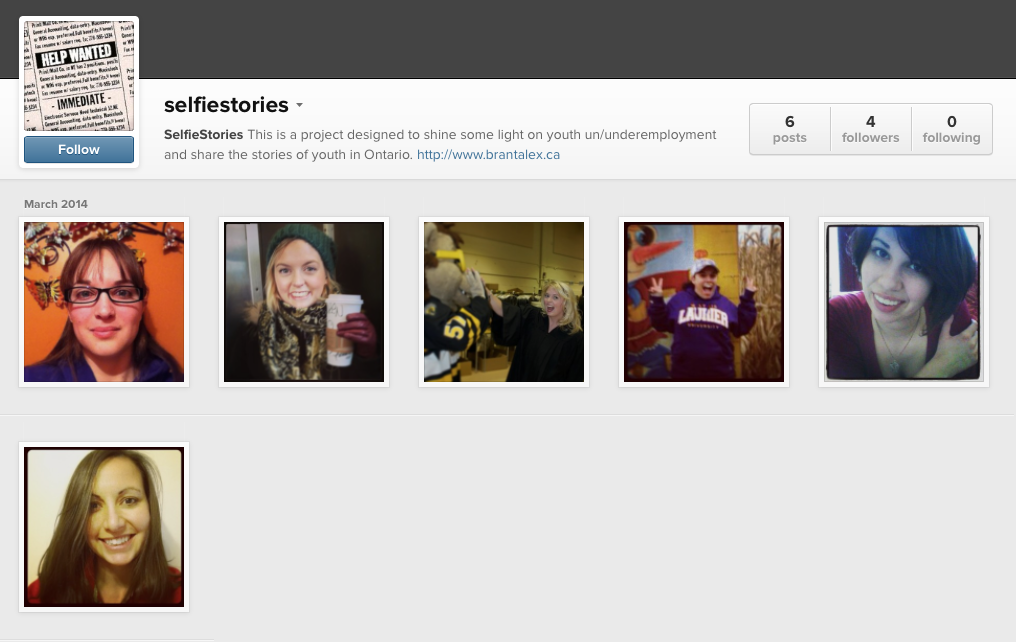

To shine some light on this problem of youth under- and unemployment, I have started a project called My #SelfieStory. It’s a collection of stories from youth about their hopes and dreams for the future, their decisions about whether to go on to post-secondary education, how they are managing to find work and what types of work are available to them.

If you’ve got a story about trying to find work after college or university, please contribute by sending me an email to alex@brantndp.ca or on Facebook to Alex Felsky. How are you managing to pay off student debt and start to settle down? Are you stuck in the viscous cycle of not having any experience, yet not being able to get any because all the jobs in your field require experience?

Please check out the project on Instagram @selfiestories and consider adding your own.